Trading Style: Value

One of the keys to successful trading is to get into stocks that are in alignment with who you are as a trader. Gladly most people fit into one of the four main investing styles: Growth, Value, Momentum and Income. This page is dedicated to the value style. Watch the short video below and read education material underneath to learn the habits of successfully trading with value stocks.

Temporarily Undervalued

Value investors and traders favor good stocks at great prices. This does not mean they have to be cheap in price however. The key is the belief that they are undervalued. That they are, for some reason, trading under what their true value or potential really is. And the value investor hopes to get in before the market 'discovers' this and moves higher.

"Value investors and traders are looking for good stocks at great prices that are trading under what their true value or 'fair value' really is."

Many institutional investors focus on this very thing.

Typical value investors will look at valuations like P/E ratios, PEG ratios, Price to Book ratios, and more.

Too many so called 'value' stocks however, have low valuations because they don't have compelling enough earnings or growth rates to speak of. So it's not enough to just look for the stocks with the lowest valuations. They might be low for a reason. Or worse, they might be damaged in some other way. These types of stocks are not value stocks. And they are definitely no bargain.

Real Value

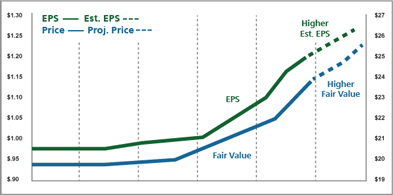

The key for value stocks is really earnings, which is the basis of most valuation models. When the Zacks Rank signals a Strong Buy or Buy (Zacks Rank #1 or #2), that means earnings estimates for a stock are rising.

Given this new information, other investors will likely view the stock as being undervalued relative to its future prospects. So, they jump in, which in turn drives the price of the stock higher. And as additional upward earnings estimate revisions come in, the fair value of the stock moves up along with it.

The Value Score further helps separate the wheat from the chaff by identifying the stocks most likely to outperform by doing a deep dive on their valuation measures. Those with a Score of A or B rate the best on these metrics and help identify the truly discounted names. When combined with the Zacks Rank they create a powerful combination for finding value stocks ready to move.

Timeliness

The beauty of the Zacks Rank is that it is also a timeliness indicator, meaning that value investors can use it to identify precisely when company's prospects are beginning to improve as opposed to waiting and waiting until it becomes obvious to everyone else. And nothing can make an investor sit up and take notice of a stock faster than rising earnings estimates.

Although, one should plan on holding onto these value gems a little longer than the typical Growth or Momentum investor as the stock unfolds from undervalued to fairly valued. As long as it remains a Zacks Rank #1 or #2 (or even #3) with a Score of A or B, you can confidently do so to maximize your upside returns.

But once it changes to a Zacks Rank #4 or #5, or a Score of a D or an F, it's time to get out. That means the earnings estimate picture has changed or their valuation components are no longer considered undervalued and it's time to pull your profits.

"Now I have more investing opportunities than I have cash because of Zacks' terrific system. My only regret is that I didn't find Zacks sooner."

- Jim Rosiak of Taylors, SC